Investing in the defense sector has long been considered a stable and lucrative opportunity for those looking to diversify their portfolios. Among the many platforms offering insights into this niche, 5starsstocks.com military stands out as a trusted resource for investors seeking detailed analysis and recommendations. Whether you're a seasoned investor or just starting, the platform's focus on defense stocks provides a unique blend of data-driven insights and market trends tailored to help you make informed decisions. With geopolitical tensions and technological advancements driving the defense industry, the platform highlights key players, emerging trends, and potential risks. By leveraging expert analysis and real-time updates, 5starsstocks.com military ensures that investors stay ahead of the curve in this dynamic sector.

As the global defense market continues to expand, understanding its intricacies becomes crucial. From aerospace giants to cybersecurity firms, the defense sector encompasses a wide range of industries, each with its own set of challenges and opportunities. Platforms like 5starsstocks.com military play a pivotal role in breaking down these complexities, offering readers actionable insights and strategies. Whether you're interested in long-term investments or short-term gains, the platform provides a comprehensive toolkit to navigate the defense stock landscape effectively.

What sets 5starsstocks.com military apart is its commitment to transparency and accuracy. The platform doesn't just list stocks; it dives deep into the factors influencing their performance, such as government contracts, international trade policies, and technological innovations. By combining qualitative and quantitative analysis, it ensures that investors have a holistic view of the market. This approach not only builds trust but also empowers users to make decisions that align with their financial goals. If you're ready to explore the world of defense investments, 5starsstocks.com military is your go-to guide.

Read also:Exploring Barron Trump Net Worth Insights Into His Life Family And Future

Table of Contents

- What Makes 5starsstocks.com Military Unique?

- How Can You Benefit from Defense Stocks?

- Key Players in the Defense Industry

- What Are the Risks of Investing in Defense?

- How Geopolitical Trends Affect Defense Stocks

- Emerging Technologies Shaping the Future

- How to Build a Defense Stock Portfolio?

- Frequently Asked Questions About 5starsstocks.com Military

What Makes 5starsstocks.com Military Unique?

When it comes to investing in defense stocks, having access to reliable and actionable information is paramount. 5starsstocks.com military distinguishes itself by offering a blend of expert analysis, real-time updates, and user-friendly tools. Unlike generic financial platforms, this site focuses exclusively on the defense sector, providing insights tailored to the unique dynamics of this industry. Whether you're tracking government contracts, analyzing geopolitical developments, or evaluating technological advancements, the platform ensures you have all the information you need at your fingertips.

One of the standout features of 5starsstocks.com military is its commitment to transparency. The platform doesn't just provide stock recommendations; it explains the "why" behind each suggestion. For instance, if a particular stock is recommended due to a lucrative defense contract, the platform breaks down the contract's value, duration, and potential impact on the company's bottom line. This level of detail helps investors make informed decisions rather than relying on guesswork. Additionally, the platform's team of analysts regularly updates its content to reflect the latest market trends, ensuring that users are always working with current data.

Beyond its analytical prowess, 5starsstocks.com military also excels in accessibility. The platform is designed to cater to both novice and experienced investors, offering resources like glossaries, tutorials, and FAQs to demystify complex financial concepts. Whether you're trying to understand the nuances of defense budget allocations or deciphering the implications of international trade agreements, the platform provides clear and concise explanations. This dedication to education and transparency is what makes 5starsstocks.com military a trusted resource for anyone looking to invest in the defense sector.

How Can You Benefit from Defense Stocks?

Investing in defense stocks offers a unique set of advantages that make them an attractive option for many investors. One of the primary benefits is their relative stability compared to other sectors. Defense companies often secure long-term contracts with governments, ensuring a steady revenue stream regardless of economic fluctuations. This stability is particularly appealing to conservative investors who prioritize consistent returns over high-risk, high-reward strategies. Additionally, the defense sector is less susceptible to consumer trends, making it a reliable choice during economic downturns.

Another significant advantage of defense stocks is their potential for growth driven by geopolitical tensions and technological advancements. As nations continue to invest heavily in their military capabilities, companies in this sector are poised to benefit from increased demand. For instance, rising tensions in regions like the Indo-Pacific or the Middle East often lead to heightened defense spending, directly impacting stock prices. Furthermore, the integration of cutting-edge technologies such as artificial intelligence, drones, and cybersecurity solutions into military operations creates new opportunities for innovation and expansion. Platforms like 5starsstocks.com military provide insights into these trends, helping investors capitalize on emerging opportunities.

Finally, defense stocks offer diversification benefits that can enhance the overall resilience of your portfolio. By including defense stocks alongside other asset classes, you can reduce your exposure to market volatility. For example, while tech stocks may experience sharp declines during economic slowdowns, defense stocks often remain stable or even appreciate due to increased government spending. This diversification potential, combined with the sector's growth prospects, makes defense stocks a valuable addition to any investment strategy. With platforms like 5starsstocks.com military guiding the way, investors can confidently navigate this lucrative sector.

Read also:Exploring The World Of Aditi Mistry Videos A Comprehensive Guide

Key Players in the Defense Industry

The defense industry is dominated by a handful of major players whose influence extends across the globe. Companies like Lockheed Martin, Boeing, and Northrop Grumman are household names in the sector, known for their cutting-edge technology and massive government contracts. These firms are often referred to as "defense primes" because they serve as the primary contractors for government projects, ranging from fighter jets to missile defense systems. Their size and scale give them a competitive edge, allowing them to secure lucrative deals and maintain a steady revenue stream. For investors, these companies represent a stable and reliable option within the defense sector.

However, the industry is not limited to these giants alone. Smaller firms and startups are increasingly making their mark, particularly in niche areas like cybersecurity, space exploration, and unmanned systems. Companies such as Palantir Technologies and AeroVironment are examples of smaller players that have carved out significant market share by focusing on specialized technologies. These firms often collaborate with larger primes, providing components or software solutions that enhance the capabilities of larger systems. This symbiotic relationship creates opportunities for investors to diversify their portfolios by including both large-cap and small-cap defense stocks.

Another important aspect of the defense industry is its global nature. While the United States remains the largest spender on defense, countries like China, India, and members of the European Union are rapidly increasing their military budgets. This global expansion has opened doors for international defense companies such as BAE Systems (UK) and Thales Group (France) to compete on a larger stage. Investors can leverage platforms like 5starsstocks.com military to track these international trends and identify opportunities beyond domestic markets. By understanding the dynamics of both established and emerging players, investors can make informed decisions that align with their financial goals.

What Are the Risks of Investing in Defense?

While the defense sector offers numerous benefits, it is not without its risks. One of the most significant challenges investors face is the sector's heavy reliance on government contracts. These contracts, while lucrative, are often subject to political and budgetary uncertainties. For instance, changes in administration or shifts in defense priorities can lead to canceled or delayed projects, directly impacting a company's revenue. Platforms like 5starsstocks.com military provide insights into these risks, helping investors stay informed about potential disruptions.

Another risk to consider is the cyclical nature of defense spending. While geopolitical tensions can drive short-term spikes in demand, prolonged periods of peace or diplomatic resolutions may lead to reduced military budgets. This volatility can make defense stocks unpredictable, particularly for investors seeking stable returns. Additionally, the sector is highly regulated, with companies required to meet stringent compliance standards. Failure to adhere to these regulations can result in fines, lawsuits, or even the loss of contracts, further complicating the investment landscape.

Finally, technological advancements pose both opportunities and risks. While innovation can drive growth, it also creates challenges for companies that fail to adapt. For example, the rapid development of autonomous systems and artificial intelligence could render older technologies obsolete, forcing companies to invest heavily in R&D to stay competitive. Investors must weigh these risks carefully and consider diversifying their portfolios to mitigate potential losses. By leveraging expert analysis from platforms like 5starsstocks.com military, investors can navigate these challenges with greater confidence.

How Geopolitical Trends Affect Defense Stocks?

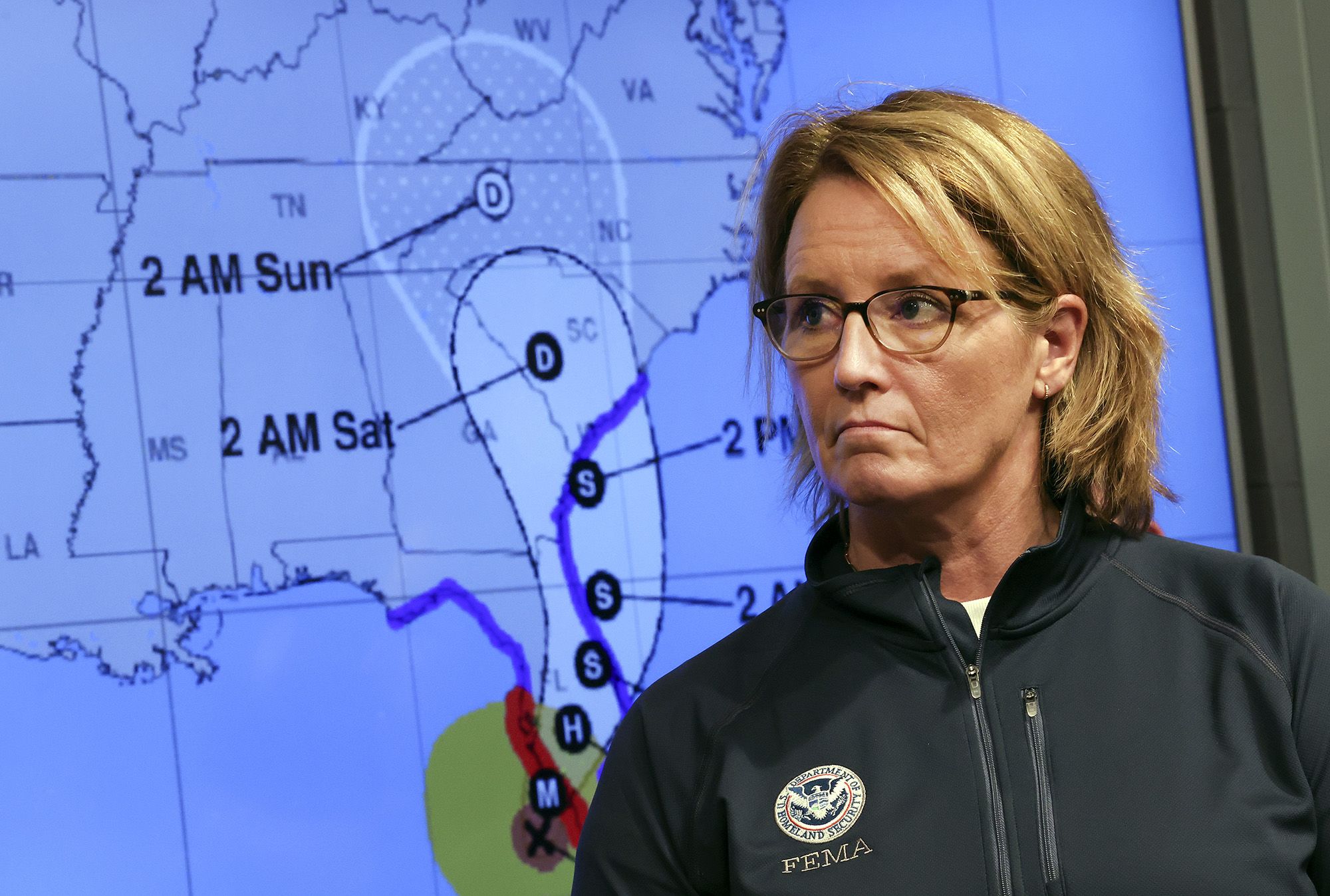

Geopolitical trends play a pivotal role in shaping the performance of defense stocks. For instance, rising tensions between major global powers often lead to increased defense spending as countries seek to bolster their military capabilities. This heightened demand directly benefits defense companies, driving up stock prices and creating lucrative investment opportunities. Platforms like 5starsstocks.com military provide real-time updates on geopolitical developments, helping investors anticipate market movements and adjust their strategies accordingly.

Regional conflicts and security threats also have a significant impact on the defense sector. For example, ongoing instability in the Middle East or the Indo-Pacific region often prompts governments to allocate additional funds for military equipment and technology. This increased spending benefits companies involved in manufacturing weapons systems, surveillance technology, and cybersecurity solutions. By staying informed about these trends, investors can identify which companies are likely to benefit and make timely investment decisions.

On the flip side, diplomatic resolutions or peace treaties can have the opposite effect, leading to reduced defense budgets and slower growth for defense stocks. Investors must remain vigilant and consider these geopolitical factors when building their portfolios. Platforms like 5starsstocks.com military offer valuable insights into how these trends unfold, enabling investors to navigate the complexities of the defense sector with greater ease and confidence.

Emerging Technologies Shaping the Future

The defense industry is undergoing a technological revolution, with innovations reshaping the way militaries operate. One of the most transformative trends is the integration of artificial intelligence (AI) into defense systems. AI-powered technologies, such as autonomous drones and predictive analytics, are enhancing the efficiency and precision of military operations. For investors, companies at the forefront of AI development represent promising opportunities. Platforms like 5starsstocks.com military provide detailed analysis of these advancements, helping investors identify stocks poised for growth.

Cybersecurity is another critical area driving the future of defense. As cyber threats become increasingly sophisticated, governments and private entities are investing heavily in advanced cybersecurity solutions. Companies specializing in encryption, threat detection, and network security are seeing significant demand, making them attractive investment options. Additionally, the rise of space-based technologies, such as satellite communications and missile defense systems, is creating new avenues for growth. Investors can leverage insights from platforms like 5starsstocks.com military to stay ahead of these emerging trends and capitalize on the sector's evolving landscape.

Finally, the push toward sustainability is influencing defense technologies as well. From energy-efficient systems to eco-friendly manufacturing processes, companies are exploring ways to reduce their environmental impact. This shift not only aligns with global sustainability goals but also opens up new markets for innovative solutions. By understanding these technological advancements, investors can position themselves to benefit from the defense industry's ongoing transformation.

How to Build a Defense Stock Portfolio?

Building a defense stock portfolio requires a strategic approach that balances risk and reward. Start by identifying your investment goals—are you seeking long-term stability, short-term gains, or a mix of both? Once you've clarified your objectives, research the key players in the defense sector, including both large-cap companies like Lockheed Martin and smaller firms specializing in niche technologies. Platforms like 5starsstocks.com military can provide valuable insights into these companies, helping you make informed decisions.

Diversification is crucial when building a defense portfolio. Consider including a mix of stocks from different segments of the industry, such as aerospace, cybersecurity, and space technology. This approach not only reduces risk but also allows you to capitalize on various growth opportunities. Additionally, keep an eye on geopolitical trends and government spending patterns, as these factors can significantly impact stock performance. Regularly reviewing and rebalancing your portfolio ensures that it remains aligned with your financial goals.

Finally, stay updated on emerging technologies and market trends. The defense sector is constantly evolving, and staying ahead of these changes can give you a competitive edge. Use platforms like 5starsstocks.com military to track developments and adjust your strategy as needed. By combining thorough research with a disciplined approach, you can build a robust defense stock portfolio that delivers consistent returns.