The Bitcoin 24 model has emerged as a revolutionary framework that provides insights into Bitcoin’s price movements and market trends. This model has gained traction among traders, investors, and analysts who are eager to understand the nuances of Bitcoin’s behavior over time. By combining historical data, market psychology, and technical analysis, the Bitcoin 24 model offers a unique perspective on how Bitcoin operates within a 24-hour cycle and beyond. Whether you're a seasoned crypto enthusiast or a newcomer to the world of digital assets, this model holds the potential to enhance your understanding of Bitcoin’s dynamics. The Bitcoin 24 model isn’t just about numbers and charts—it’s a tool that helps decode the rhythm of the cryptocurrency market. Bitcoin, being the pioneer of digital currencies, operates in a decentralized and highly volatile environment. The 24-hour cycle reflects the constant activity of global markets, where traders from different time zones contribute to price fluctuations. By breaking down these cycles, the Bitcoin 24 model enables users to identify patterns, anticipate trends, and make informed decisions. It’s like having a roadmap for navigating the unpredictable terrain of cryptocurrency trading. With its ability to analyze market sentiment and volume spikes, this model has become an essential resource for anyone looking to maximize their returns. What makes the Bitcoin 24 model particularly fascinating is its adaptability to different trading strategies. Whether you’re a day trader looking for quick profits or a long-term investor aiming to capitalize on Bitcoin’s growth potential, the model can be tailored to suit your needs. By understanding the interplay between market cycles, investor psychology, and macroeconomic factors, the Bitcoin 24 model empowers users to make smarter, data-driven decisions. In this article, we’ll explore the intricacies of the Bitcoin 24 model, delve into its applications, and answer some of the most pressing questions surrounding this innovative framework. Let’s embark on this journey to uncover how the Bitcoin 24 model can transform your approach to cryptocurrency investments.

Table of Contents

- What is the Bitcoin 24 Model and How Does It Work?

- Why is the Bitcoin 24 Model Important for Traders and Investors?

- How Can You Use the Bitcoin 24 Model to Predict Market Trends?

- What Are the Key Components of the Bitcoin 24 Model?

- How Does the Bitcoin 24 Model Differ from Other Market Models?

- What Are the Limitations of the Bitcoin 24 Model?

- Can the Bitcoin 24 Model Be Applied to Other Cryptocurrencies?

- Frequently Asked Questions About the Bitcoin 24 Model

What is the Bitcoin 24 Model and How Does It Work?

The Bitcoin 24 model is a framework designed to analyze Bitcoin’s price movements and market behavior within a 24-hour cycle. Unlike traditional financial markets that operate during specific hours, the cryptocurrency market runs 24/7, creating a unique environment where price fluctuations occur continuously. This model leverages this constant activity to identify patterns and trends that can be used to predict future movements. By examining factors such as trading volume, market sentiment, and historical price data, the Bitcoin 24 model provides a comprehensive view of how Bitcoin behaves over time.

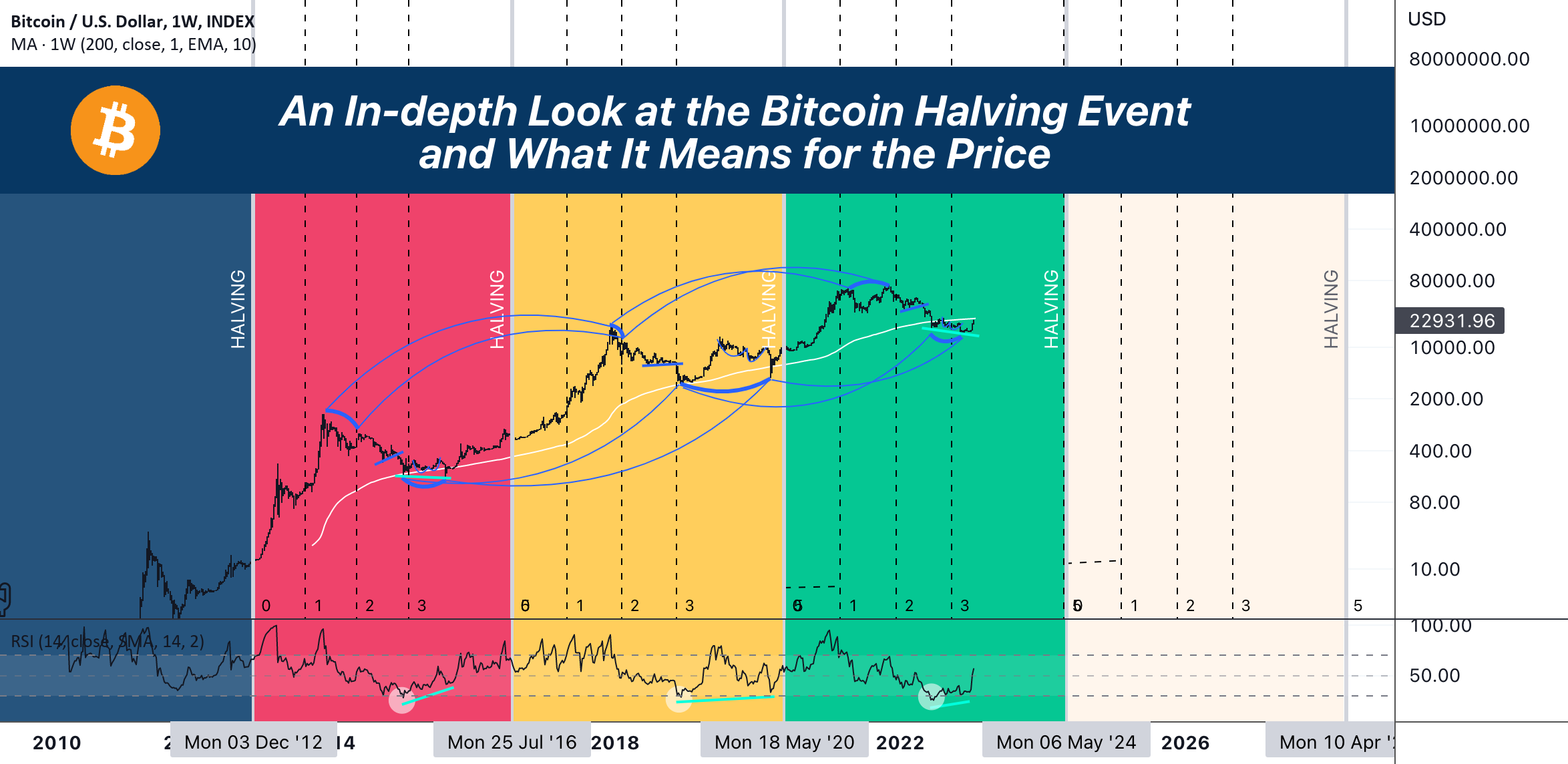

At its core, the Bitcoin 24 model focuses on the cyclical nature of the cryptocurrency market. It divides the 24-hour period into segments, each representing different phases of market activity. For instance, during certain hours, trading volume may spike due to increased activity from specific regions, while other hours may see a lull as traders take a break. By understanding these cycles, users can identify optimal times to buy, sell, or hold Bitcoin. The model also incorporates technical indicators such as moving averages, relative strength index (RSI), and support/resistance levels to provide a more nuanced analysis of market conditions.

Read also:Tamil Big Boops A Comprehensive Guide To Understanding And Appreciating Tamil Cinema

One of the standout features of the Bitcoin 24 model is its ability to adapt to changing market dynamics. As Bitcoin continues to evolve, so too does the model. It takes into account macroeconomic factors, regulatory developments, and technological advancements that influence Bitcoin’s price. For example, news about institutional adoption or regulatory crackdowns can significantly impact market sentiment, and the Bitcoin 24 model helps users stay ahead of these developments. By combining quantitative data with qualitative insights, the model offers a holistic approach to understanding Bitcoin’s behavior.

How Does the Bitcoin 24 Model Analyze Market Sentiment?

Market sentiment plays a crucial role in the Bitcoin 24 model. The model uses sentiment analysis tools to gauge the mood of traders and investors based on social media activity, news articles, and forum discussions. By monitoring these sources, the model can detect shifts in sentiment that may indicate upcoming price movements. For instance, a surge in positive sentiment on platforms like Twitter or Reddit could signal a potential price rally, while negative sentiment might suggest an impending downturn.

What Role Does Historical Data Play in the Bitcoin 24 Model?

Historical data is a cornerstone of the Bitcoin 24 model. By analyzing past price movements and market trends, the model identifies recurring patterns that can be used to predict future behavior. This data-driven approach ensures that users have access to reliable insights that are grounded in real-world observations. Additionally, the model incorporates machine learning algorithms to refine its predictions over time, making it more accurate and responsive to changing market conditions.

Why is the Bitcoin 24 Model Important for Traders and Investors?

The Bitcoin 24 model has become an indispensable tool for traders and investors who want to stay ahead in the fast-paced world of cryptocurrency trading. One of the primary reasons for its importance is its ability to provide real-time insights into market trends. By breaking down the 24-hour cycle into manageable segments, the model allows users to identify opportunities that might otherwise go unnoticed. Whether you’re looking to capitalize on short-term price movements or plan for long-term investments, the Bitcoin 24 model offers valuable guidance.

Another key aspect of the Bitcoin 24 model is its focus on risk management. Cryptocurrency markets are notoriously volatile, and making uninformed decisions can lead to significant losses. The model helps mitigate this risk by providing a structured approach to analyzing market conditions. For example, by identifying periods of high volatility, users can adjust their trading strategies to minimize exposure. Similarly, the model’s emphasis on technical indicators ensures that users have access to reliable data that can inform their decision-making process.

Moreover, the Bitcoin 24 model fosters a deeper understanding of market psychology. By examining how traders react to different events and news, the model sheds light on the underlying forces that drive price movements. This psychological insight is invaluable for anyone looking to navigate the complex world of cryptocurrency trading. Whether you’re a novice trader or an experienced investor, the Bitcoin 24 model equips you with the tools you need to succeed in this dynamic market.

Read also:Understanding The Registro Civil Ec A Comprehensive Guide To Ecuadors Civil Registry

Can the Bitcoin 24 Model Help You Avoid Common Trading Mistakes?

One of the most common mistakes traders make is acting on impulse without a clear strategy. The Bitcoin 24 model helps address this issue by providing a systematic framework for analyzing market conditions. By following the model’s guidelines, users can avoid emotional decision-making and focus on data-driven insights. This disciplined approach not only improves trading outcomes but also builds confidence in one’s ability to navigate the market successfully.

How Does the Bitcoin 24 Model Enhance Your Trading Strategy?

The Bitcoin 24 model enhances trading strategies by offering a multi-faceted view of the market. It combines technical analysis, sentiment analysis, and historical data to provide a comprehensive understanding of Bitcoin’s behavior. This holistic approach ensures that users have access to all the information they need to make informed decisions. Additionally, the model’s adaptability allows users to tailor their strategies to suit their individual goals, whether they’re focused on short-term gains or long-term growth.

How Can You Use the Bitcoin 24 Model to Predict Market Trends?

Using the Bitcoin 24 model to predict market trends involves a combination of technical analysis, sentiment analysis, and pattern recognition. The first step is to familiarize yourself with the model’s framework and understand how it divides the 24-hour cycle into distinct phases. Each phase represents a different level of market activity, and by analyzing these phases, you can identify patterns that indicate potential price movements. For example, a consistent increase in trading volume during a specific phase may signal an upcoming price rally.

Once you’ve identified these patterns, the next step is to incorporate technical indicators into your analysis. The Bitcoin 24 model relies heavily on indicators such as moving averages, RSI, and Bollinger Bands to provide a more detailed view of market conditions. These indicators help confirm the trends you’ve identified and provide additional context for your predictions. For instance, if the RSI indicates that Bitcoin is overbought, it may suggest that a price correction is on the horizon.

Finally, it’s important to stay updated on external factors that could influence Bitcoin’s price. The Bitcoin 24 model takes into account macroeconomic developments, regulatory changes, and technological advancements that impact the cryptocurrency market. By staying informed about these factors, you can refine your predictions and make more accurate forecasts. This proactive approach ensures that you’re always one step ahead in the ever-changing world of cryptocurrency trading.

What Are the Best Tools for Implementing the Bitcoin 24 Model?

To effectively implement the Bitcoin 24 model, you’ll need access to a range of tools and resources. Trading platforms like Binance and Coinbase offer advanced charting tools that allow you to analyze price movements and technical indicators. Additionally, sentiment analysis tools such as LunarCrush and Santiment can help you gauge market sentiment based on social media activity and news articles. By combining these tools with the Bitcoin 24 model, you can create a robust framework for predicting market trends.

How Can You Test the Bitcoin 24 Model’s Predictions?

Testing the Bitcoin 24 model’s predictions involves backtesting and simulation. Backtesting involves analyzing historical data to see how the model’s predictions would have performed in the past. This process helps validate the model’s accuracy and identify areas for improvement. Simulation, on the other hand, involves creating hypothetical scenarios to test the model’s predictions under different market conditions. Both methods ensure that you have confidence in the model’s ability to deliver reliable insights.

What Are the Key Components of the Bitcoin 24 Model?

The Bitcoin 24 model is built on several key components that work together to provide a comprehensive view of the cryptocurrency market. These components include technical analysis, sentiment analysis, historical data, and external factors. Each of these elements plays a crucial role in the model’s ability to predict market trends and guide trading decisions.

Technical analysis is one of the most important components of the Bitcoin 24 model. It involves the use of charts and indicators to analyze price movements and identify trends. Common technical indicators used in the model include moving averages, RSI, and MACD. These indicators help users understand the current state of the market and make informed predictions about future price movements.

Sentiment analysis is another key component of the Bitcoin 24 model. By monitoring social media activity, news articles, and forum discussions, the model gauges the mood of traders and investors. This information is used to identify shifts in sentiment that may indicate upcoming price movements. For example, a surge in positive sentiment on platforms like Twitter or Reddit could signal a potential price rally.

How Does Historical Data Contribute to the Bitcoin 24 Model?

Historical data is a critical component of the Bitcoin 24 model. By analyzing past price movements and market trends, the model identifies recurring patterns that can be used to predict future behavior. This data-driven approach ensures that users have access to reliable insights that are grounded in real-world observations. Additionally, the model incorporates machine learning algorithms to refine its predictions over time, making it more accurate and responsive to changing market conditions.

What External Factors Influence the Bitcoin 24 Model?

External factors such as macroeconomic developments, regulatory changes, and technological advancements play a significant role in the Bitcoin 24 model. These factors can have a profound impact on Bitcoin’s price and market sentiment. For example, news about institutional adoption or regulatory crackdowns can significantly influence market sentiment, and the Bitcoin 24 model helps users stay ahead of these developments. By combining quantitative data with qualitative insights, the model offers a holistic approach to understanding Bitcoin’s behavior.

How Does the Bitcoin 24 Model Differ from Other Market Models?

The Bitcoin 24 model stands out from other market models due to its focus on the 24-hour cycle and its ability to adapt to the unique characteristics of the cryptocurrency market. Unlike traditional financial